Instead, you’ll pay taxes when you withdraw the money during retirement. A traditional IRA lets you deduct your deposits (up to $6,000 a year) from your annual earned income, meaning you don’t pay income taxes on the money.Capital One Bank offers traditional and Roth IRAs. 360 IRA Savings AccountĮveryone who has a job should have an Individual Retirement Account, or IRA.

Looking at the numbers, a $10,000 investment would be guaranteed to yield a return of $50 a year in the 12 month CD account. If you did need to access your money before the CD term matures, you’ll have to pay a fee that will negate a chunk of your interest earnings. Longer terms tend to come with higher interest rates, but not always. In exchange for getting a fixed rate on your savings you agree to leave the money alone throughout the CD’s term - whether it’s 3 months, 60 months, or longer. (Interest rates in non-CD savings accounts are always subject to change.) Essentially, CDs are savings accounts that let you lock in interest rates. In case you’re unfamiliar with certificates of deposit, here’s a brief refresher. So, if you’re a fan of no-risk investing, and would like to stretch your earnings further than you could get in a savings account, the 360 CD could be a good option for you. With a Capital One 360 CD account, investors can earn 0.30% APY on one year online deposits and a 0.60% APY on 5-year CDs. Once again, there are no fees or minimum balances to keep a MONEY account open - as it should be! 360 Certificates of Deposit When the account holder turns 18, the MONEY account automatically graduates to a 360 Checking account. However, children age 8 and older can participate - as long a parent or legal guardian signs on as a joint account holder. MONEY Teen Checking AccountĪs this name suggests, Capital One’s MONEY account is designed for teens. Of course, this savings account is also FDIC-insured.Ĭap One does not have a money market account. You don’t need to maintain a minimum balance to keep a fee-free 360 Performance Savings account open. Account-holders can earn an impressive 0.50% annual percentage yield (APY) by simply keeping their money in this high-yield savings account. Capital One 360 SavingsĬapital One’s savings account offering is called 360 Performance Savings. You’ll also have easy-to-use banking options like bill pay and mobile banking. Or, you could set up an overdraft line of credit to avoid fees.

CAPITAL ON 360 CHEQUEBOOK FULL

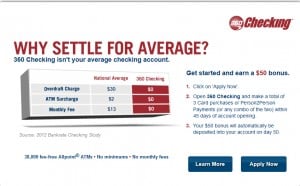

This account’s overdraft fee of $35 is steep, but the bank has a one-day grace period which gives you a full business day to transfer money to cover a transaction before the fees kick in. That’s right - no fees and an interest bearing account balance. Even if your account drops to $0, you still aren’t charged any monthly fees.Īnd - you’ll earn an APY of 0.1 percent on all balances. There is no minimum deposit required to open the account (and no minimum balance required to keep it open, either). There are no fees to use the account-unlike many of the major national banks (such as Chase and Bank of America). What Services Does Capital One Bank Offer?Ĭapital One offers the following services:Ĭapital One’s checking account is called 360 Checking. Whether you access the bank’s services online or face-to-face, you’ll get a full-service approach for your personal finances: The bank has checking accounts, savings accounts, credit cards, auto loans, and even corporate loans. You’ll get the feel of an online bank with high-interest savings accounts and easy-to-use mobile apps.īut the bank also has about 750 physical branches and 40,000+ dedicated ATMs - a physical presence that resembles a brick-and-mortar bank, at least in some states. too.įor consumers, Capital One Bank provides a hybrid approach in the banking industry. It employs more than 48,000 people across the U.S., and in Canada and the U.K. In fact, Capital One Bank is the 10th-largest banking institution in the nation. In 2012, the bank acquired ING Direct to become one of the major players in the U.S. In 2005, the company launched its consumer bank which grew steadily through acquisitions during its first few years of operation. which started as a credit card issuer in the 1980s and expanded into auto lending in the 1990s. In This Article Capital One Bank: A Banking HybirdĬapital One Bank is the consumer banking arm of Capital One Financial Corp. Today, I’d like to explore everything Capital One Bank has to offer so you can decide whether you should use this online bank. With so many choices, deciding where to park your money can feel overwhelming - and too many people make a random decision without comparing rates, fees, and services. Should you open a bank account at a major national branch down the street, join a credit union, or opt for an online bank?

0 kommentar(er)

0 kommentar(er)